Introduction: Why Should You Care About a SpaceX Explosion?

Imagine waking up to headlines about a SpaceX Starship explosion at Starbase, Texas. For many, this seems like distant news—exciting for space fans, but irrelevant to your daily life. But what if I told you that events like the SpaceX explosion today could ripple through the financial markets, affecting your investments and, ultimately, your personal wealth?

As a personal finance expert with years of experience guiding individuals through market turbulence, I’ve seen how news from companies like SpaceX, even though it’s private, can shake investor confidence and influence the value of your diversified investment portfolio. In this article, we’ll break down what happened with the recent launch incident, why it matters for your money, and what practical lessons you can use to safeguard and grow your wealth—even when rockets explode.

Personal finance book (“The Intelligent Investor”) — Beginning of the article:

Right after the introduction, when the article emphasizes the importance of understanding how major events can impact your investments, insert the book as a suggestion for readers who want to deepen their knowledge of solid investment strategies.

⚠️ Important Note: This article is for educational and informational purposes only and does NOT constitute financial advice. Always consult with a qualified professional for your specific situation. Investments involve risk. This content reflects our views and experience, not a recommendation.

As an Amazon Associate and affiliate of other programs, we may earn qualifying commissions from links in this article at no additional cost to you. Read our Full Disclaimer and Privacy Policy.

You’ll learn:

Let’s dive in and ensure you’re prepared for the next big headline.

What Happened with SpaceX and the Launch Failure?

On a recent morning, SpaceX’s Starship suffered a dramatic explosion at its launch site in Texas. This wasn’t the first rocket explosion from SpaceX, nor will it be the last as the company pushes the boundaries of space technology. But each high-profile failure, especially one like this involving the Starship vehicle, draws global attention.

Even though SpaceX is a private company, its activities are closely tied to public companies—think Tesla, whose CEO Elon Musk also leads SpaceX, and countless suppliers and partners. When a major spacecraft explodes, it can shake confidence in Musk’s ventures, impacting stocks like Tesla and ETFs exposed to the space and innovation sectors.

💡 Key Insight: Major events at SpaceX, such as launch failures, can indirectly affect a wide range of public companies and investment funds, even if the rocket company itself isn’t publicly traded.

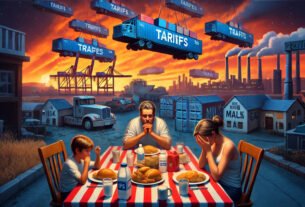

[Image placeholder: Rocket explosion at Texas launch facility, with emphasis on visual impact and team reaction. Alt-text: “Rocket explosion at Texas launch facility, illustrating the risks of technological innovation.”]

How Do SpaceX Explosions Affect Your Diversified Investment Portfolio?

When you hear about a SpaceX explosion today, you might wonder: “Does this really impact my investments?” The answer is yes—sometimes in subtle, sometimes in significant ways.

Let’s break it down:

Market Sentiment: News of a rocket explosion can trigger negative sentiment, especially in tech and innovation sectors.

Stock Prices: Tesla shares, for example, often react to news involving Elon Musk, even if the event is unrelated to Tesla’s core business.

ETFs and Mutual Funds: Many funds include companies linked to the space industry or Musk’s ventures, so their value can fluctuate after such events.

Example: Tesla and the Ripple Effect

After previous SpaceX incidents, Tesla’s stock has sometimes dipped, reflecting investor anxiety about Musk’s leadership or the future of his companies. If you own an S&P 500 ETF or a technology-focused mutual fund, you’re likely exposed to these swings.

💡 Key Insight: Even private company events, like major launch failures, can impact public markets through related stocks and funds in your diversified investment portfolio.

Para os interessados em inovação e tecnologia, e que desejam aprender mais sobre os bastidores de empresas que estão nas manchetes, “Elon Musk: Tesla, SpaceX e a Busca por um Futuro Fantástico”, de Ashlee Vance, é leitura obrigatória. Este livro oferece detalhes fascinantes sobre a jornada de Musk, os desafios enfrentados por suas empresas e como suas decisões influenciam o mercado. É uma excelente recomendação para leitores que buscam conectar o mundo dos investimentos com a tecnologia e a exploração espacial.$32.79

Why Is Diversification Essential When Space News Shakes the Market?

What Is a Diversified Investment Portfolio and Why Does It Matter?

A diversified investment portfolio spreads your money across different assets—stocks, bonds, real estate, and more—to reduce risk. When a single event, like a Starship explosion, rattles one sector, your other investments can help cushion the blow.

Risks of Overconcentration

If you’re heavily invested in tech or innovation, a SpaceX setback could hit your portfolio hard. Diversification helps ensure that no single event wipes out your gains.

Impact of Space-Related Events on Different Portfolio Types:

| Portfolio Type | Exposure to SpaceX/Tesla | Potential Impact from SpaceX Explosion | Risk Level |

|---|---|---|---|

| Tech-Heavy (e.g., NASDAQ ETF) | High | Significant short-term volatility | High |

| Diversified (S&P 500 Index) | Moderate | Some impact, but cushioned by other sectors | Medium |

| Bonds & Real Assets Focused | Low | Minimal direct impact | Low |

💡 Key Insight: Diversification is your best defense against unpredictable events like rocket explosions, helping you weather the storm and stay on track with your financial goals.

Should You React to Starship Explosions or Stay Focused on the Long Term?

How Should You Respond When the Market Reacts to Space News?

It’s tempting to panic when you see headlines about a space x explosion today or a sudden drop in your portfolio. But history shows that short-term volatility is normal—and often temporary.

Tips for Staying the Course

Review Your Goals: Remember why you invested in the first place.

Avoid Knee-Jerk Reactions: Selling in a panic often locks in losses.

Rebalance Regularly: Adjust your diversified portfolio as needed, but stick to your plan.

[Image placeholder: Investor monitoring portfolio performance during aerospace news coverage, emphasizing long-term strategy. Alt-text: “Investor monitoring portfolio performance during space industry news, emphasizing long-term strategy.”]

💡 Key Insight: Market shocks from events like a Starship explosion are inevitable. Your long-term strategy matters more than short-term headlines.

How Can You Analyze the Real Impact of SpaceX News on Your Portfolio?

What Tools and Sources Should You Use to Track Market Reactions?

Not every rocket explosion or launch incident will affect your investments equally. Here’s how to assess the real impact:

Monitor Reliable News: Use trusted financial news sources and official SpaceX updates.

Check Your Portfolio Exposure: Look for funds or stocks linked to SpaceX, Tesla, or the broader innovation sector.

Use Portfolio Analysis Tools: Platforms like Morningstar, Yahoo Finance, and your brokerage’s dashboard can help.

Practical Steps

- Set up alerts for major companies in your diversified portfolio

- Review fund fact sheets to understand sector exposure

- Consult with a financial advisor if you’re unsure about your risk

💡 Key Insight: Informed investors use data and trusted sources to evaluate the impact of events like rocket explosions, rather than reacting emotionally.

Frequently Asked Questions (FAQ)

Q1: Can a SpaceX explosion really affect my diversified investment portfolio? A: Yes. Even though SpaceX is private, its events can influence related public companies and funds, impacting your portfolio’s value.

Q2: Should I sell my tech stocks after a major Starship explosion? A: Not necessarily. Short-term volatility is common, but long-term strategies usually outperform panic selling.

Q3: How can I protect my investments from events like rocket explosions at Starbase? A: Maintain a diversified investment portfolio, review your asset allocation, and avoid overconcentration in any single sector.

Q4: Where can I find reliable information about SpaceX and market impacts? A: Use reputable news outlets, official SpaceX updates, and financial analysis tools from established platforms.

Conclusion: What’s the Real Lesson from Launch Failures for Your Portfolio?

Major events like rocket explosions at launch facilities remind us that innovation comes with risks—and those risks can ripple through the financial markets. But you have the power to protect your wealth by building and maintaining a diversified investment, staying informed, and focusing on your long-term goals.

Don’t let dramatic headlines dictate your financial future. Instead, use these moments as reminders to review your strategy, rebalance if needed, and keep your eyes on the bigger picture.

Ready to take your portfolio to the next level? Discover the 10 Essential Strategies for a Diversified Investment Success for even more actionable tips and expert insights.

💡 Key Insight: The best investors aren’t those who avoid risk entirely, but those who prepare for it with a well-diversified investment portfolio and a clear plan for the future.

“Pai Rico, Pai Pobre: O que os Ricos Ensinam aos Filhos sobre Dinheiro que os Pobres e a Classe Média Não Ensinam!”, de Robert Kiyosaki, é um best-seller global que transformou a maneira como milhões de pessoas pensam sobre dinheiro. Por meio das lições contrastantes de seus dois “pais”, Kiyosaki explica a importância da educação financeira, dos investimentos e da construção de patrimônio em vez de simplesmente ganhar um salário. Este livro oferece insights práticos sobre como se libertar do ciclo de viver de salário em salário, desenvolver uma mentalidade de riqueza e tomar decisões mais inteligentes sobre dinheiro — tornando-se uma leitura essencial para quem busca assumir o controle de seu futuro financeiro.$14.15

Internal Links:

- How to Build a Diversified Portfolio in Your 40s

- ETF Investing: What You Need to Know for 2025

- Understanding Market Volatility and Your Investments

External Links:

U.S. Securities and Exchange Commission (SEC)

Morningstar Portfolio Analysis

For a deeper dive into building resilience in your investments, check out the 10 Essential Strategies for a Diversified Investment Portfolio Success.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult a qualified financial advisor before making investment decisions. Information is current as of June 19, 2025.

Author: Michael holds an MBA in business management. He worked for 5 years as an investment consultant. He also works as a freelancer for a security company. He is the creator and writer of the finance article WalletWise.blog — where he shares practical tips and his experiences. His mission is to make the financial world simpler, more accessible and free of hidden fees.

Simple strategies, great results. Make your money count!